Amanuensis: A person employed to write what another dictates or to copy what has been written by another.

I continue my project to transcribe family letters, journals, newspaper articles, audiotapes, and other historical artifacts. Not only do the documents contain genealogical information, the words breathe life into kin - some I never met - others I see a time in their life before I knew them.

Today I share the Tax Assessment for my second great grandparents, Selig and Anna Feinstein. A Tax Assessment being the total value of the property owned upon which property tax is calculated. The local newspaper in 1910 listed the tax assessments for every individual or company above $5,000. (Over 12,000 people.) While theoretically property value is still public information, one would not expect a list like this to appear in a newspaper today.

As I mentioned in some recent posts, Selig and Annie were living in the tenement section in 1900, though according to the census, they owned the tenement. I have not been able to verify this yet by finding the deed, though I have looked in microfilm for it. They went into the real estate business between 1900 and 1910. Family lore has said that Selig was moderately successful, but somehow lost a lot of his money.

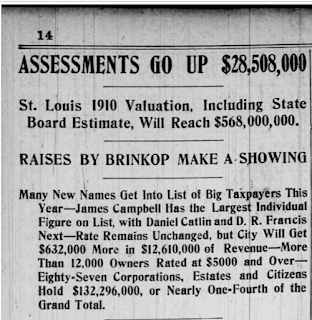

ASSESSMENTS GO UP $28,508,000

St. Louis 1910 Valuation, Including State Board Estimate, Will Reach $568,000,000

RAISES BY BRINKOP MAKE A SHOWING

Many New Names Get Into List of Big Taxpayers This Year — James Campbell Has the Largest Individual Figure on List, with Daniel Catlin and D.R. Francis Next — Rate Remains Unchanged, but City Will Get $632,000 More in $12,610,000 of Revenue — More Than 12,000 Owners Rated at $5,000 and Over — Eighty-Seven Corporations, Estates and Citizens Hold $132,296,000, or Nearly One-Fourth of the Grand Total.

Combining the individual assessment for my second great grandfather, with the joint assessment with his wife, the total is $29,860.

Notes1) The CPI Inflation Calculator begins with January 1913. $29,860 in January of 1913 is equivalent to $849,492.62 in December of 2021. I do not know how many pieces of property they owned, or the difference between the property Selig owned individually, and what they owned jointly.

No comments:

Post a Comment